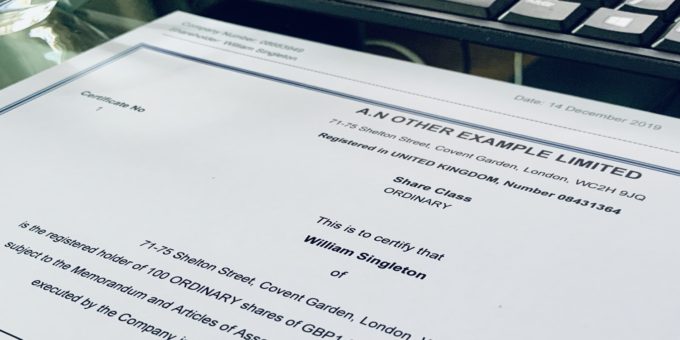

A share certificate is a legal document that verifies a person’s shareholdings in a company. It’s essentially a dated receipt proving that the named person is the registered owner of a certain quantity and class of shares in a particular company.

This post discusses the importance of share certificates in UK companies limited by shares. We explain how and when to create them, the information they should contain, and how to issue replacements.

Issuing share certificates in a UK private limited company

The Companies Act 2006 (section 768) defines a share certificate as “prima facie evidence” (accepted as correct until proved otherwise) of a person’s title to the specified shares. For companies registered in Scotland, a certificate “is sufficient evidence, unless the contrary is shown, of his title to the shares”.

When a company allots (issues) new shares or authorises the transfer of existing shares from one person to another, it must provide a share certificate to the relevant shareholder (member). In accordance with section 769 of the Companies Act, the certificate must be delivered to the member no later than two months after the date of allotment or transfer.

- Transfer of Shares Service - only £69.99

- Issue of Shares Service from 1st Formation - only £79.99

- A guide to company shares

Share certificates remain an important aspect of recording company ownership, along with the register of members and the use of digital cap tables.

They help safeguard shareholders’ interests and rights, facilitate the transfer of ownership, and enable companies to identify and keep track of genuine shareholders. Sometimes, shareholders can use them as collateral when applying for loans or financing.

Information to include on a share certificate

Many companies create branded share certificates featuring their logo and company seal. However, if preferable, you can use a template from a legal stationer or company formation agent instead. This is the simplest option and ideal for startups and small firms.

Whichever option you choose, each share certificate your company issues should include the following information:

- Company name and company registration number

- The company’s registered office address

- Unique certificate number

- Date of issue

- Class of shares issued or transferred

- Number of shares issued or transferred

- Nominal value of each share

- Shareholder’s name and address

The certificate must also contain the signatures of two directors, or one director and the company secretary. If you are the sole director and do not have a company secretary, a witness must be present and provide a second signature.

At 1st Formations, we’ve created a standard share certificate template suitable for a private company limited by shares with ‘Ordinary’ shares. You can use this for your company or as a reference when creating your own design. Click on the image below to download a free copy.

Your company should keep a copy of every share certificate it issues, including cancelled, damaged, or defaced certificates. There is no need to provide copies to Companies House or HMRC.

Should you issue share certificates on paper or electronically?

Traditionally, companies have issued paper certificates to shareholders and retained hard copies for their internal records. However, issuing and storing share certificates electronically is becoming increasingly common.

In fact, the UK’s Digitisation Taskforce is proposing to eliminate the use of paper share certificates in favour of a more efficient digital system. The proposals focus on public companies, but there is also a discussion of whether digitisation could extend to private companies.

- A guide to transferring and issuing company shares

- What are my shareholder rights?

- Tax implications of transferring shares to your spouse or partner

Issuing and transferring shares held electronically is faster and more cost-effective than dealing with paper certificates. Holding shares digitally also eliminates the risk of lost or damaged certificates. This reduces the administrative burden and costs associated with their replacement.

In the meantime, UK companies can choose whichever certificate format they prefer. However, retaining PDF copies as a backup would be worthwhile if you issue paper certificates.

Do you have to issue separate certificates for each share?

The Model articles of association (part 3, article 24.1) states that a “company must issue each shareholder, free of charge, with one or more certificates in respect of the shares which that shareholder holds.”

This means you can issue one certificate per shareholder for all shares of the same class that are issued or transferred to that person on a specific date. Alternatively, you can issue separate certificates for each share, even if the same shareholder takes all of them.

It’s standard practice for companies to issue only one certificate per shareholder for an allotment or transfer of shares of the same class. Generally, companies will only ‘split’ share certificates upon the shareholder’s request or when required under the articles.

However, you must issue a separate certificate for each class when allotting or transferring shares of different classes.

Updating the register of members and PSC register

After issuing or transferring shares, a company must update its register of members and register of people with significant control (PSC register) accordingly. Most companies keep these statutory registers at their registered office address.

Upon the issue of new shares, the company must record the following details (where applicable) in its register of members:

- name and address of every new shareholder

- date(s) of share allotment

- class and quantity of shares held

- amount paid or agreed to be paid on each share

Upon the transfer of shares from one person to another, the company must record the following details (where applicable) in its register of members:

- name and address of every new shareholder

- date(s) of share transfer

- date(s) on which any person ceased to be a member upon transferring their shares

- updated shareholdings of every member who acquired or transferred shares

You only need to update the PSC register if an allotment or transfer of shares triggers any change to the company’s PSC information.

Upcoming changes to the rules on statutory registers

Under the Economic Crime and Corporate Transparency Act 2023, the requirement for companies to maintain certain internal registers will be abolished. When these measures come into effect, companies will no longer have to keep a register of directors, register of directors’ residential addresses, register of secretaries, or PSC register.

The Companies House register will become the sole source of this information, with companies only required to maintain an internal register of members. However, until the UK Government implements these changes, you must continue to keep all company registers up to date.

How long do share certificates remain valid?

Share certificates do not have an expiry date. Upon issue, a certificate remains valid until the named shareholder sells or transfers their shares. At that time, the company should cancel the existing certificate and issue a new one to the new shareholder.

Issuing a replacement share certificate

When a share certificate is lost, stolen, or accidentally damaged or destroyed, the shareholder is still the rightful owner of the shares. Provided their details remain on the register of members, their claim to their shareholdings and all attached rights are protected.

Nevertheless, the shareholder must inform the company immediately and request a replacement. The company should then confirm that the request is genuine, cancel the old certificate to prevent any fraudulent use, and issue a replacement to the shareholder. The replacement should have a new unique certificate number rather than the same number as the original.

Before issuing a new certificate, there may be a requirement for the shareholder to comply with certain conditions imposed by the company, such as:

- providing a signed statement of facts about the loss or damage

- obtaining a letter of indemnity to protect the company against potential loss or liability in the event of any misuse of the original certificate

- payment of a reasonable sum to cover any associated costs of replacing the certificate

Where a certificate is damaged or defaced, or a lost certificate is found, the shareholder must return it to the company. The company should mark it as cancelled and retain it to avoid any potential misuse or confusion.

When issuing replacement certificates, it’s good practice to record the particulars of the event in meeting minutes. The company should also mark the old certificate as cancelled in any list of valid share certificates it may have.

Thanks for reading

We hope you’ve found this post helpful in understanding the purpose and importance of share certificates. Explore the 1st Formations Blog for limited company guidance and small business advice.

Please note that the information provided in this article is for general informational purposes only and does not constitute legal, tax, or professional advice. While our aim is that the content is accurate and up to date, it should not be relied upon as a substitute for tailored advice from qualified professionals. We strongly recommend that you seek independent legal and tax advice specific to your circumstances before acting on any information contained in this article. We accept no responsibility or liability for any loss or damage that may result from your reliance on the information provided in this article. Use of the information contained in this article is entirely at your own risk.

Join The Discussion