When you set up a UK limited company one of your first priorities should be to open a dedicated business bank account.

This is not a legal obligation (despite what you may read online) but it is recommended for a number of reasons.

In this blog post, we’re going to look at these reasons and show how you can select an account when forming your company with us, or even after you’ve formed your company.

Let’s get started…

4 reasons why your limited company needs a business bank account

Separate your personal and business finances – The alternative to opening a business bank account is to use your regular personal account for business purposes too. However, this will make the preparation of your tax returns particularly laborious as you will have to distinguish between personal and business transactions.

In more general terms, a business account will give you immediate insight into your business’s financial wellbeing. In just a few clicks you will be able to see your company’s finances. Without this dedicated account, you will always need to manually calculate what’s yours and what’s the company’s.

Make a professional impression – One of the major benefits of running your business as a limited company is the professional impression that the structure exudes. If you request that payments be made into a personal account, you’re potentially undoing this work. Business contacts may question your quality of service and even legitimacy.

Take advantage of the features – The leading business banks offer various features designed to make running your business that much simpler. Online and app banking is very much the norm now – and on top of this you can expect to see banks providing integrations with accounting and invoicing software, access to business advice, and much more.

Get a loan – The majority of banks will not offer you a loan or line of credit without an account that’s dedicated to your limited company. Even if this is not something that you’re not interested in, it’s always good to have the option available to you. Furthermore, without a business bank account, you will not be able to build up a company rating.

Form your company and pick a business bank account

UK Customers

As part of our company formation process, we offer free introductions to several business bank account providers. This means that if you choose to set up your company with us, you have the option to select what banks you’re interested in at the same time as forming your company.

This is one of the many benefits of forming a company with us, rather than directly with Companies House.

Generally speaking, our UK-based customers can choose from the below banks:

- Anna

- Barclays

- HSBC

- Zempler

- NatWest

- Monzo

- Tide

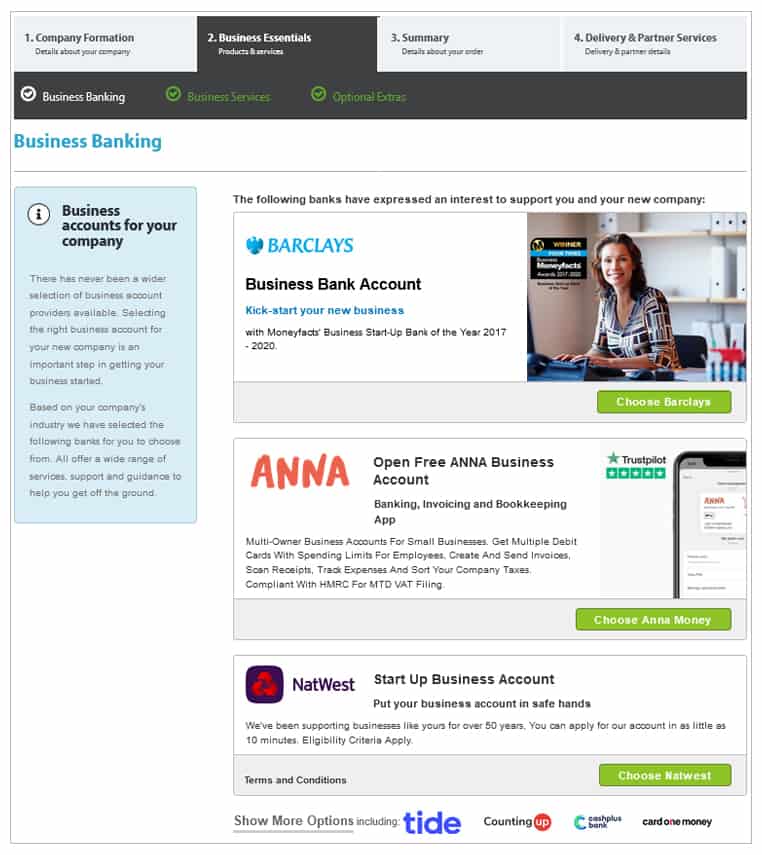

The exact banking partners available to you will differ depending on your SIC code (the code that sets out the industry in that you’ll be operating).

International customers

Our overseas customers have the option to apply for a UK business account with WorldFirst.

If you purchase the Non-Residents Package or the eSeller Package, you will be provided with a referral to WorldFirst, which will allow you to open a UK bank account without needing to visit the UK. Alternatively, you can add a referral to WorldFirst at the end of the order process when purchasing the Prestige Package or the All Inclusive Package.

While we do not guarantee that your application to open a business bank account will be successful – each bank has different opening criteria – you will find that our process simplifies your search for the right bank.

Selecting your bank whilst forming your company is simple

Once you have chosen your company formation package (unfortunately, we can not offer a banking introduction as part of our Limited By Guarantee package) and made the payment, you will be guided to the company formation process.

It is here that you appoint your company officers, allocate shares, and set your registered office address.

After you have provided all of the necessary company information – this being what’s required to get the company formed at Companies House – we’ll present the banks that are available to you via the ‘Business Essentials’ section of the process:

All you need to do is select the ‘Choose’ button next to the bank that you’re interested in, then continue through the process.

Finally, before your application is sent to Companies House for approval, we’ll ask you to give the contact information for who the bank should get in touch with (this is particularly relevant if your company has more than one officer).

Then once your company has been formed, the bank will make contact and provide further information on opening your business bank account.

But what happens if you don’t select a business bank account during the company formation?

Don’t worry, you can still access the online introductions, even after your company has been set up. Here’s how:

- Log in to your 1st Formations account

- Choose the ‘My Companies’ option

- Select the appropriate company

- Click on the ‘Getting Started’ tab

You will then be presented with the list of business bank account providers that we work with.

Choose the ‘Add To Card’ option next to any of the offers that you’re interested in, then proceed to the checkout to complete the order (no payment is necessary). You will then receive an email with further instructions.

Thanks for reading

So there you have it, why you need a business bank account and how to choose a business bank account while setting up your company.

We hope you have found this blog post helpful. Please leave a comment if you have any questions.

Please note that the information provided in this article is for general informational purposes only and does not constitute legal, tax, or professional advice. While our aim is that the content is accurate and up to date, it should not be relied upon as a substitute for tailored advice from qualified professionals. We strongly recommend that you seek independent legal and tax advice specific to your circumstances before acting on any information contained in this article. We accept no responsibility or liability for any loss or damage that may result from your reliance on the information provided in this article. Use of the information contained in this article is entirely at your own risk.

Join The Discussion

Comments (8)

Very good to know, thank you!

Thanks for the feedback! We’re glad it was useful.

Regards,

The 1st Formations Team

Hello

I need help with set up a business account for my limited company.

Thanks for your kind comment, Dumi.

We will send you an email to assist you.

Kind regards,

The 1st Formations Team

How long does it take to set up an ANNA account?

Thanks for the comment.

Accounts can be opened in as little as 3 minutes!

Regards,

The 1st Formations Team

Nice to know I can still choose a banking referral after the company has been formed. Are they all reliable banks?

Thanks for the comment!

Yes – we only partner with tried and trusted banking providers.

Regards,

The 1st Formations Team