Every entrepreneur reaches a pivotal moment — the decision to stop working for someone else and start building something of their own.

But before the launches, funding rounds, IPOs, and successful exits, most founders were navigating day jobs, battling self-doubt, and questioning whether there was more to life than the 9-to-5 grind.

This article explores four inspiring real-life stories of successful founders who launched their companies with 1st Formations. We delve into what they were doing before making the leap into self-employment — and how they turned ambition into action.

“At 1st Formations, our mission is to empower aspiring entrepreneurs to take that all-important first step — because there’s no perfect moment to launch a business, only the courage to pursue a great idea,” says Graeme Donnelly, CEO and founder of 1st Formations, the UK’s leading company formation agent. “It’s incredibly rewarding to see visionary founders like those behind Bloom Money, Neverleft, Runna, and Monk choose us to help bring their ventures to life. We’re proud to have played a small part in their remarkable journeys.”

Key Takeaways

- There’s no perfect time or path to starting a business. Whether you’re fresh out of university or deep into a demanding career, a great business idea can strike at any moment.

- Personal experience often sparks the best ideas. Each founder identified a real problem from their own life and created a business to solve it.

- You often don’t need to quit your job to get started. Several of these entrepreneurs began building their companies while working full-time, using evenings and weekends to test and grow their ideas.

Monk: beating entrepreneurial burnout with cold water therapy

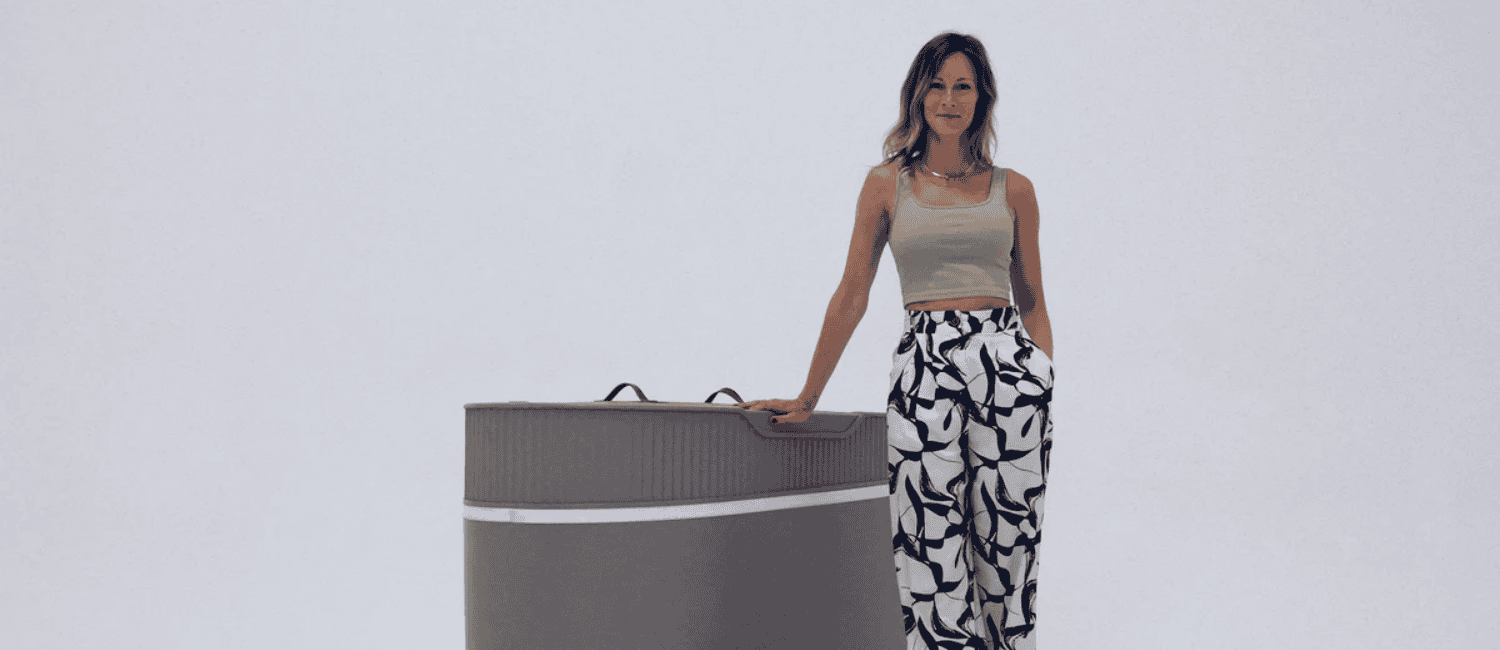

Laura Fullerton founded Monk in 2021 after experiencing the benefits of cold water therapy first-hand.

Monk is the world’s first smart ice bath and app designed to make cold water therapy more accessible, personalised, and effective. The Monk ice bath is ergonomically designed and self-cleaning, while the integrated app provides guided plunge programmes and syncs with wearable devices.

Here’s what led founder Laura Fullerton to create Monk.

Before starting Monk, I’d already founded and exited a couple of businesses. On paper it sounds great, but I’d been going a million miles an hour, and I was burnt out. Then one day I discovered cold water therapy.

I thought I was going to hate it, but it was like pressing the reset button – it gave me so much clarity and this sense of resilience. I wanted more of it, but learnt the hard way that it was inaccessible: clunky, expensive, and lacked personalisation. So I did what any problem-solver does: I built the solution I wished existed.

Monk was born out of that moment – turning an ancient ritual into an accessible, smart, and scientifically-backed experience.

Laura’s burnout led her to conceptualise a product that did not yet exist. As an already-experienced founder, she knew that it was up to her to create it before others did. This proves that ideas can strike when you least expect, and you must seize the opportunity when it presents itself.

Monk’s achievements so far

Monk has already secured £2 million in funding, attracting investors such as former world heavyweight boxing champion Anthony Joshua, Oura co-founder Petteri Lahtela, and BrewDog founder James Watt. Additionally, the company reported a waiting list exceeding 3,000 individuals ahead of its UK and US launch, and ranks #68 on The Startups 100 Index.

Runna: a side project turned #1 ranked running app

Dom Maskell and Ben Parker founded Runna in 2021. It’s become one of the fastest-growing running training apps in the world, used by hundreds of thousands of runners from more than 180 countries.

Here’s what they were doing in the years before launching, as told by Runna’s Partnerships Associate, Fiona Gallagher.

Ben and Dom met playing lacrosse at Southampton University. After graduating, Dom joined McKinsey & Company, while Ben qualified as a personal trainer and running coach. Years later, Ben was in London managing his own online running coaching business. He was coaching Dom to improve his 5K personal best time and to run his first marathon.

Dom continued to see Ben get busier with his coaching business before reaching out and pitching his plan to automate it. The idea of Runna was born.

After around nine months of evening work, they launched a website that built personalised PDFs, called The Run Buddy. Then, Runna as an app was created. Now, Runna is the number one rated running coaching service around the world, helping hundreds of thousands of people every day!

Dom and Ben laid the foundations of Runna while still working full-time, proving you don’t have to quit your day job to create something incredible. They combined their professional experience in product management and fitness coaching and stayed driven by their shared passion for running to turn this side project into a massive global success.

Runna’s achievements so far

Runna secured £5 million in a recent venture capital round, bringing the total funds raised since 2021 to over £8 million. Dom and Ben were listed in Forbes’ 30 Under 30 last year, and Runna is ranked #6 on The Startups 100 Index 2025.

Bloom Money: born to back overlooked communities

Nina Mohanty founded Bloom Money in 2021 after recognising that traditional banks in the UK fail to support migrants and refugees.

Many immigrants arriving in the UK face significant challenges when navigating the local financial system, often lacking a credit history and familiarity with traditional banking services. To help bridge this gap, Nina founded Bloom Money — a digital platform specifically designed to support the financial needs of diaspora communities. Bloom Money empowers users to manage traditional community-based savings and credit systems, such as ajo, esusu, and pardna, in a modern and secure way. By digitising these money clubs, the platform makes it easier for users to save collectively, access credit, and build a financial foundation in their new home.

Here’s what Nina was doing before founding Bloom.

Before taking the leap into entrepreneurship, I had built a career as a fintech operator. In hindsight, it’s something I’m incredibly proud of and naturally led me to spot the opportunity to build Bloom Money.

Having built products at Mastercard, Starling Bank, Bud, and Klarna, I was frustrated that there was very little attention to innovation happening within financial services for immigrant communities. I became obsessed with this gap in the market and finally built conviction to take the leap after over a year of desk research and validation interviews!

Nina built a successful career in fintech, working with some of the industry’s leading companies. But after repeatedly noticing a gap in the market — and a growing need that remained unaddressed — she decided it was time to take action. Her journey is a powerful reminder that professional expertise, combined with a drive to challenge the status quo, can be the catalyst for building a business that truly makes a difference.

Bloom Money’s achievements so far

Nina Mohanty raised approximately £1.2 million in pre-seed funding from mostly female, immigrant, and BIPOC investors. In 2023, she was featured in Forbes’ 30 Under 30: Finance. Bloom Money ranks #61 on The Startups 100 Index 2025 and is shortlisted for Startup 100’s Diversity, Equity, and Inclusion (DEI) award, underscoring its commitment to empowering underrepresented communities.

Neverleft: from uni nights out to a smart tech solution

Nick Papaliakos Athanasiou and Awad Ahmed founded Neverleft in 2022 after graduating from the University of Kent.

Neverleft is a business-to-business SaaS platform which streamlines the process of checking in items at venues and events. The product replaces traditional paper cloakroom ticket systems with text messages to improve security and venues’ operational efficiency.

Nick Papaliakos Athanasiou explains what it was like to found a business straight after education.

I was in my final year for my bachelor’s degree, and I took part in their startup incubator called ASPIRE, where they teach you how to think innovatively and turn your thoughts into products. I also partied a lot and went to a lot of events, which is how I conceptualised the idea of Neverleft.

I was cooking up the concept for a few months, and when I finally finished my university exams, I got an impressive number of butterflies in my stomach. So, I submitted my company application and said ‘Well there’s no going back now’.

Nick spotted a real-world problem during his nights out and decided to take the leap of faith to solve it. He also took advantage of the resources he had during his business degree by attending a startup incubator. This journey proves you don’t need decades of experience to start a business, just a problem worth solving and the courage to go for it.

Neverleft’s achievements so far

Neverleft is in its early stages, yet it has already been used by some of London’s busiest venues, helping thousands of people check in items quickly and securely. It was also at the Euro 2024 tournament in Germany, providing innovative bike parking for attendees. Currently, Neverleft is gearing up for its next round of funding.

Your turn now…

These four founders prove there’s no set route to starting your own business. All you need is a good idea and the determination to bring it to life.

Whether you’re fresh out of university like Nick, burnt out from a previous venture like Laura, or frustrated by a gap in the market like Nina, take this as your sign. You can turn your experience into something extraordinary.

- Humble beginnings: Levi Roots’ inspiring story

- The UK’s Business Growth Service: A game-changer for SMEs

All these founders started their journey the same way: by setting up their limited company with 1st Formations. Are you ready to join them?

With 1st Formations, setting up your company is quick and simple. You’ll be ready to start trading in as little as 24 hours. Contact us if you have any questions; our team of experts will be happy to help.

Please note that the information provided in this article is for general informational purposes only and does not constitute legal, tax, or professional advice. While our aim is that the content is accurate and up to date, it should not be relied upon as a substitute for tailored advice from qualified professionals. We strongly recommend that you seek independent legal and tax advice specific to your circumstances before acting on any information contained in this article. We accept no responsibility or liability for any loss or damage that may result from your reliance on the information provided in this article. Use of the information contained in this article is entirely at your own risk.

Join The Discussion