Shortly after setting up your limited company, a CT41G letter will be sent by HMRC to your registered office. In this post we look at what this letter is, explain what you need to do with the CT41G letter, and answer any questions that you may have relating to it.

What is the purpose of the CT41G letter?

The letter is sent out for a number of reasons:

- To give you your company’s Unique Taxpayer Reference (UTR)

- To give you your company’s Tax Office number

- To provide information about Corporation Tax and instructions on how to proceed if you’re trading or dormant

What to do with the CT41G letter

All you need to do with the CT41G letter is read it and follow the instructions accordingly. It would also be diligent to store the letter, or a copy, with your company records.

Previous versions of the letter included a ‘CT41G Form’ and a ‘CT41G Dormant Company Insert’ that could be completed by hand and posted to HMRC. However, these have now been phased out, with the letter directing the reader to provide all appropriate information online.

It’s this previous reliance on the ‘CT41G Form’ and ‘CT41G Dormant Company Insert’ that has made use of the catch-all term ‘CT41G’ prevalent, even though it is only mentioned in the letter once.

What instructions does the letter give?

The letter provides different instructions depending on how the company was set up and the current trading status of the company.

For companies that were set up using the GOV.UK ‘Set up a limited company and register for Corporation Tax’ service – the letter instructs the reader that they should soon receive an activation code (via post) for HMRC’s online Corporation Tax services.

For trading companies that were not set up using the GOV.UK ‘Set up a limited company and register for Corporation Tax’ service – the letter instructs the reader to visit the Corporation Tax: trading and non-trading page.

For non-trading or dormant companies that were not set up using the GOV.UK ‘Set up a limited company and register for Corporation Tax’ service – the letter instructs the reader to visit the Tell HMRC your company is dormant for Corporation Tax page.

To authorise an agent (or accountant) to deal with the company’s Corporation Tax – the letter instructs the reader to visit the Appoint someone to deal with HMRC on your behalf page.

When will I receive my letter?

Your CT41G letter should be received within 1 month of your company being formed. This will be delivered to your company’s registered office and addressed to the company as a whole, not a company director.

The letter will be automatically sent by HMRC, as Companies House will notify them when a new company is formed). You do not need to apply for one.

What to do if you have misplaced your CT41G letter

If your company was formed by 1st Formations (and you are using our registered office service) – You will have received an email with a scan of the letter attached as soon as it was received by us. You can view this scan from your 1st Formations account. To do this:

- Log in to your online company manager

- Select ‘My Mail’

- The PDF will be available to view immediately

If your company was not formed by 1st Formations – Whilst you can’t request that the CT41G letter be resent, you can:

- Request a copy of your Corporation Tax UTR to be resent to your registered office

- Contact HMRC directly for information on your Tax Office number

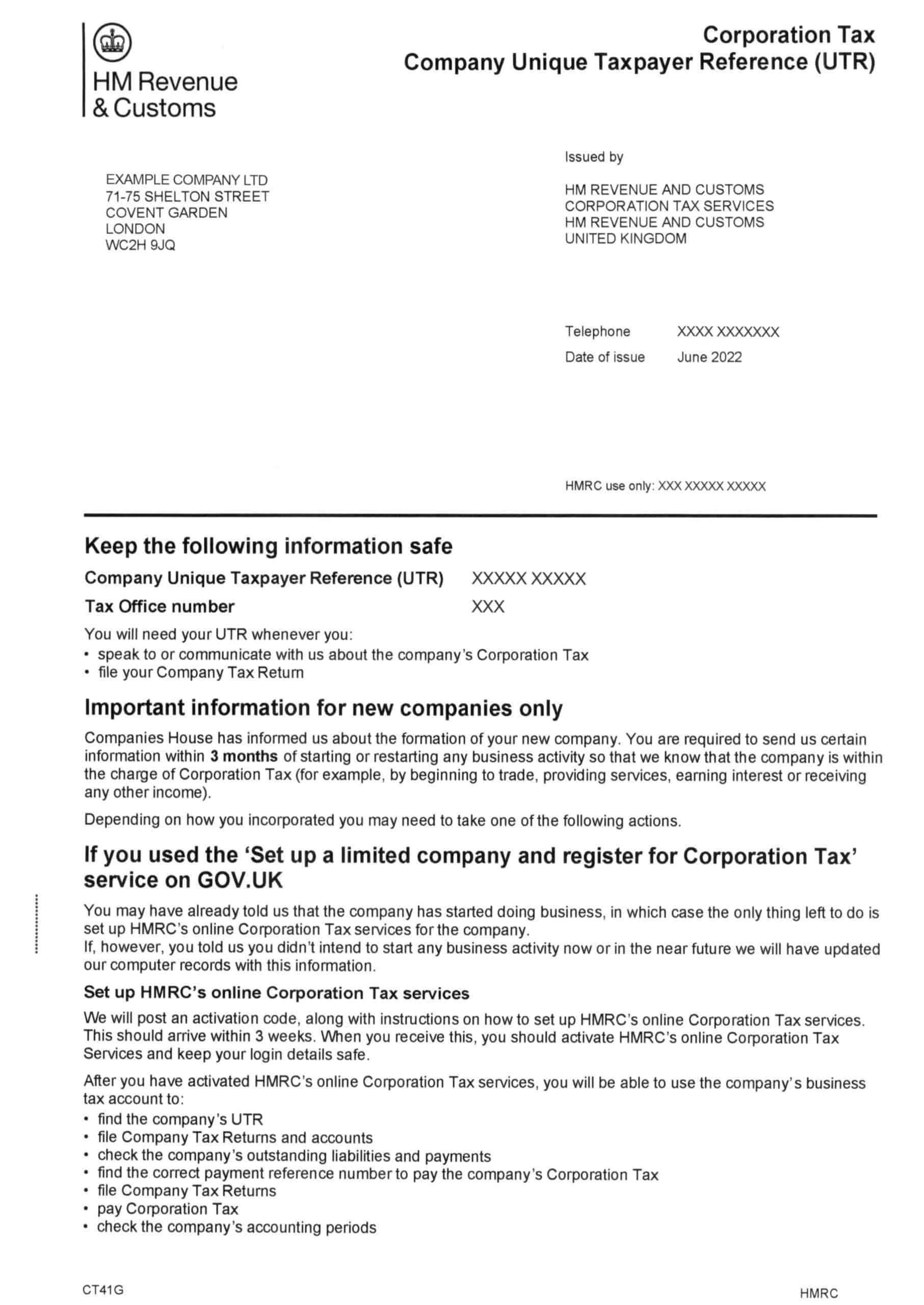

- View the image at the bottom of this blog to view the letter in full

Potential confusion around the CT41G

The official title of the CT41G letter is ‘Corporation Tax: Company Unique Taxpayer Reference (UTR)’. The only reference to ‘CT41G’ that you will find in the letter is in the footer of the first page.

Nonetheless, the phrase ‘CT41G’ is commonly used by accountants, company formation agents (such as ourselves), and other professional service providers when referring to this letter. This is because, as previously mentioned, the letter used to include a ‘CT41G Form’ and ‘CT41G Dormant Company Insert’ that needed to be filled out and returned to HMRC.

To add to the confusion, a CT41G (Clubs) form is still in use. The purpose of this form is to notify HMRC, if ‘a club, society, voluntary association or other similar body has started any business activity.’

Here’s what the CT41G letter looks like?

So there you have…

That’s everything you need to know about the CT41G letter.

We hope you have found this post helpful. If you have any questions please don’t hesitate to get in touch with a comment. We’ll then get back to you as soon as possible.

Thanks for reading.

Please note that the information provided in this article is for general informational purposes only and does not constitute legal, tax, or professional advice. While our aim is that the content is accurate and up to date, it should not be relied upon as a substitute for tailored advice from qualified professionals. We strongly recommend that you seek independent legal and tax advice specific to your circumstances before acting on any information contained in this article. We accept no responsibility or liability for any loss or damage that may result from your reliance on the information provided in this article. Use of the information contained in this article is entirely at your own risk.

Join The Discussion