After setting up a limited company, one of your priorities should be to open a business bank account.

Whilst this is not a legal obligation, it is strongly recommended, as it helps you keep your personal finances separate from your business finances, which will be extremely helpful when it comes to doing your accounts.

You’ll probably come across the acronym ‘IBAN’ when researching different business bank account providers. In this post, we’re going to explain exactly what an IBAN is. Let’s get started.

Key Takeaways

- An International Bank Account Number (IBAN) is a unique alphanumeric code that helps facilitate secure money transfers.

- Businesses and individuals need an IBAN when receiving or sending money internationally. When receiving payments, you must provide your IBAN to the sender, and when making payments, you will need the recipient’s IBAN.

- An IBAN identifies a specific bank account, whereas a SWIFT code (also called a BIC) identifies a bank.

What is an IBAN?

IBAN stands for ‘International Bank Account Number’.

The purpose of this number is to make sending and receiving money overseas more efficient and secure. As this would suggest, IBANs are relevant to businesses that will be trading internationally or working with people not based in the UK.

The IBAN is a unique identifier for your bank account and comprises of:

- Banking provider information

- Country of bank account

- Sort code

- Account number

Essentially, it is your bank account information standardised into a global format.

How do you use the IBAN?

There are two general scenarios when you will need to use an IBAN:

- If you are receiving money from a person or business outside of the UK, you will need to provide your IBAN (and BIC) to whoever is making the payment

- If you are sending money to a person or business outside of the UK, you will need to know the IBAN (and BIC) of the person or business receiving the payment

Is it safe to give an IBAN number to someone?

Notifying someone of your IBAN is safe. It only exposes data allowing someone to send money to you, rather than giving someone the ability to withdraw money. However, it is still a good idea to send the number independently and not as part of a scan of a document, such as a bank statement.

How is an IBAN structured?

The structure of an IBAN varies depending on its country of origin. In the UK, an IBAN is 22 characters long.

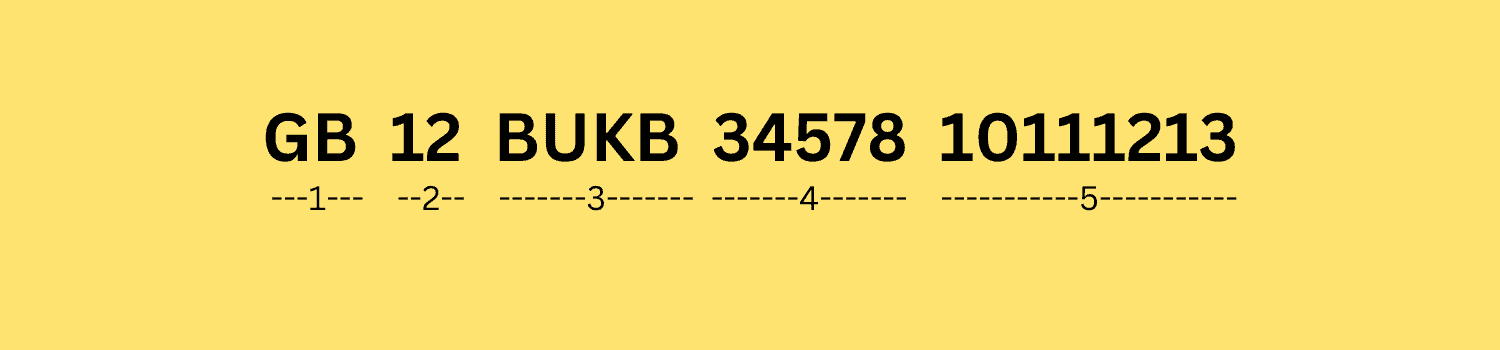

Here’s an example of an IBAN for a UK-based bank account:

- GB: The country code of the bank account provider

- 12: These are ‘check digits’ and they verify the IBAN

- BUKB: The bank code (BUKB is the code for Barclays)

- 345678: The sort code

- 0111213: The bank account number

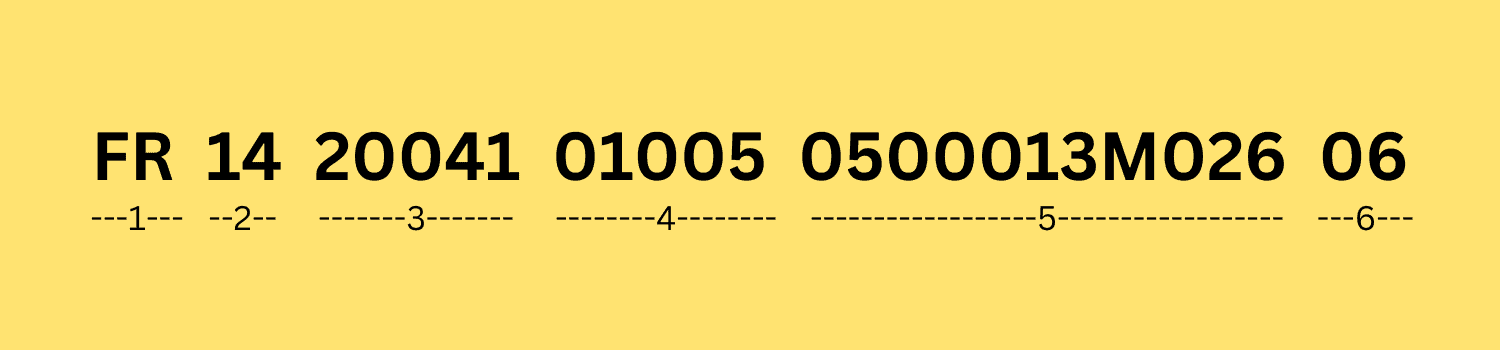

In France, an IBAN is made up of 27 characters. Here’s how a French IBAN is structured:

- FR: Country code

- 14: Check digits

- 20041: Bank code

- 01005: Branch code

- 0500013M026: Bank account number

- 06: National check digits.

In Germany, an IBAN is 22 characters. Here’s an example of how a German IBAN looks:

- DE: Country code

- 89: Check digits

- 30740044: Bank code (BLZ code)

- 0532013000: Bank account number

You can use the official IBAN checker or the free Wise IBAN checker to find out which bank the IBAN belongs to (the bank code) and validate the branch code and account number.

IBAN vs. SWIFT code: What’s the difference?

An IBAN identifies an individual account, while a SWIFT code (Society for Worldwide Interbank Financial Telecommunication) identifies a specific bank. Both are used to make international payments.

You may also see a SWIFT referred to as a BIC, which stands for ‘Business Identifier Code’. These are the same thing.

- 7 reasons why you need a business bank account

- How to create an invoice for your limited company

- 5 legal obligations after setting up a limited company

The SWIFT code / BIC helps international banks ascertain the bank that money is being sent to, like a postcode for a bank.

All banks have their own SWIFT code, and it’s common for a bank to have more than one. They are generally 8 or 11 alphanumeric characters.

Do I need a SWIFT code if I have an IBAN?

You may need to provide both an IBAN and a SWIFT code to ensure the bank can accurately direct the funds. However, not all countries use the IBAN system. If you’re transferring money to a country that doesn’t, you’ll only need the SWIFT code for the transaction.

Your bank or financial institution should be able to confirm which details they require. If a company is sending you money, they should reach out to request your IBAN, SWIFT code, or both.

Do all countries use an IBAN?

The IBAN format is used in nearly 80 countries, including most countries in Europe and the United Arab Emirates. The IBAN website provides a full list of where it is used for domestic and international payments.

Whilst IBAN is not the standard in North America, Australia, or New Zealand – it is recognised, so payments can be made using it.

Do all banking providers issue an IBAN?

No. If you are in the process of looking for a business bank account and will require an IBAN, we recommend checking with the provider before you start the account opening process.

Some services allow you to calculate your own IBAN, but this method is not guaranteed to be reliable.

How to find your IBAN (and your bank’s BIC)

If you have been issued an IBAN, you can find it on your bank statement. If you use online banking, you can also locate it on your online banking portal.

You can use the same method to find your bank’s BIC.

1st Formations can help you open a business bank account

All of our company formation packages come with the facility to opt-in to one of our business banking partners during the company formation process. Whilst the exact banking options that you see during the process can differ, we work with the following business banking providers:

Simply select the service you’re interested in, and we’ll email you more information about the online account opening process. Find out more in our blog: What our business banking partners can offer you.

Already formed your company with 1st Formations? Not a problem. You can still take advantage of our business banking options. All you need to do is:

- Log in to your Online Company Manager

- Select ‘My Companies’

- Click on your company name

- Select the ‘Getting Started’ tab

- You will be presented with a list of available banks – click ‘Add To Cart’ next to the account that you’re interested in

- Complete the checkout process (no payment is required)

- You will then receive an email with more information

So there you have it

The IBAN (or International Bank Account Number) makes the sending and receiving of money overseas more efficient and secure.

We hope you have found this post helpful. Please leave a comment if you have any questions.

Thanks for reading.

Please note that the information provided in this article is for general informational purposes only and does not constitute legal, tax, or professional advice. While our aim is that the content is accurate and up to date, it should not be relied upon as a substitute for tailored advice from qualified professionals. We strongly recommend that you seek independent legal and tax advice specific to your circumstances before acting on any information contained in this article. We accept no responsibility or liability for any loss or damage that may result from your reliance on the information provided in this article. Use of the information contained in this article is entirely at your own risk.

Join The Discussion