One of the first duties of a limited company director is to ensure that the company’s details are appropriately displayed on all official business stationery and promotional materials. This includes letters, invoices, and the company website.

The information that must be displayed depends on where it is shown. In some cases, additional regulations may apply. This blog explains the information limited companies must legally display and where.

Key Takeaways

- Business stationery is all official business correspondence and promotional material, such as business letters, order forms, and websites.

- All UK-registered companies must clearly display their registered office address, jurisdiction, and company registration number on all business stationery.

- VAT-registered businesses must also show their VAT registration number on all business stationery, websites, and invoices.

Types of business stationery

Business stationery (also known as company stationery) is your official business correspondence and documentation. As per The Company, Limited Liability Partnership and Business (Names and Trading Disclosure) Regulations 2015, this includes:

(a) its business letters, notices, and other official publications;

(b) its bills of exchange, promissory notes, endorsements and order forms;

(c) cheques purporting to be signed by or on behalf of the company;

(d) orders for money, goods or services purporting to be signed by or on behalf of the company;

(e) its bills of parcels, invoices and other demands for payments, receipts and letters of credit;

(f) its applications for licences to carry on a trade or activity; and

(g) all other forms of its business correspondence and documentation.

Essentially, business stationery is any written or digital material you use to communicate with or advertise your company to external parties, such as customers, clients, and suppliers. It also includes promotional materials like your website and social media channels.

Where company information is displayed, the regulations state that it “must be in characters that can be read by the naked eye.”

- 10 duties and responsibilities of a company director

- Running a business from home – what you need to know

- VAT registration for UK companies with non-resident directors

Let’s now look at the exact company details you should showcase on different materials.

Business letters, order forms, and websites

In accordance with Regulation 25 of The Names and Trading Disclosure Regulations 2015, you must display the following information on all business letters, order forms, and websites:

(a) The part of the United Kingdom in which the company is registered;

(b) The company’s registered number;

(c) The address of the company’s registered office.

For company websites, the above information doesn’t need to be on every single page but rather in a central location where it can be easily found and read. The most convenient place is often the footer.

These regulations also apply to emails, as they are the digital equivalent of a physical business letter. Again, you’d typically find company details in the footer.

To ensure your business complies with the law, we recommend all employees set up an automatic email signature with the necessary company details.

Directors’ names

You may choose to include directors’ names on your company stationery. This is optional. However, if you decide to include them, you must display the names of all directors.

If you’re registered for VAT

If your company is registered for Value-Added Tax (VAT), its VAT registration number must also be displayed on all business stationery, websites, and invoices.

Invoice requirements

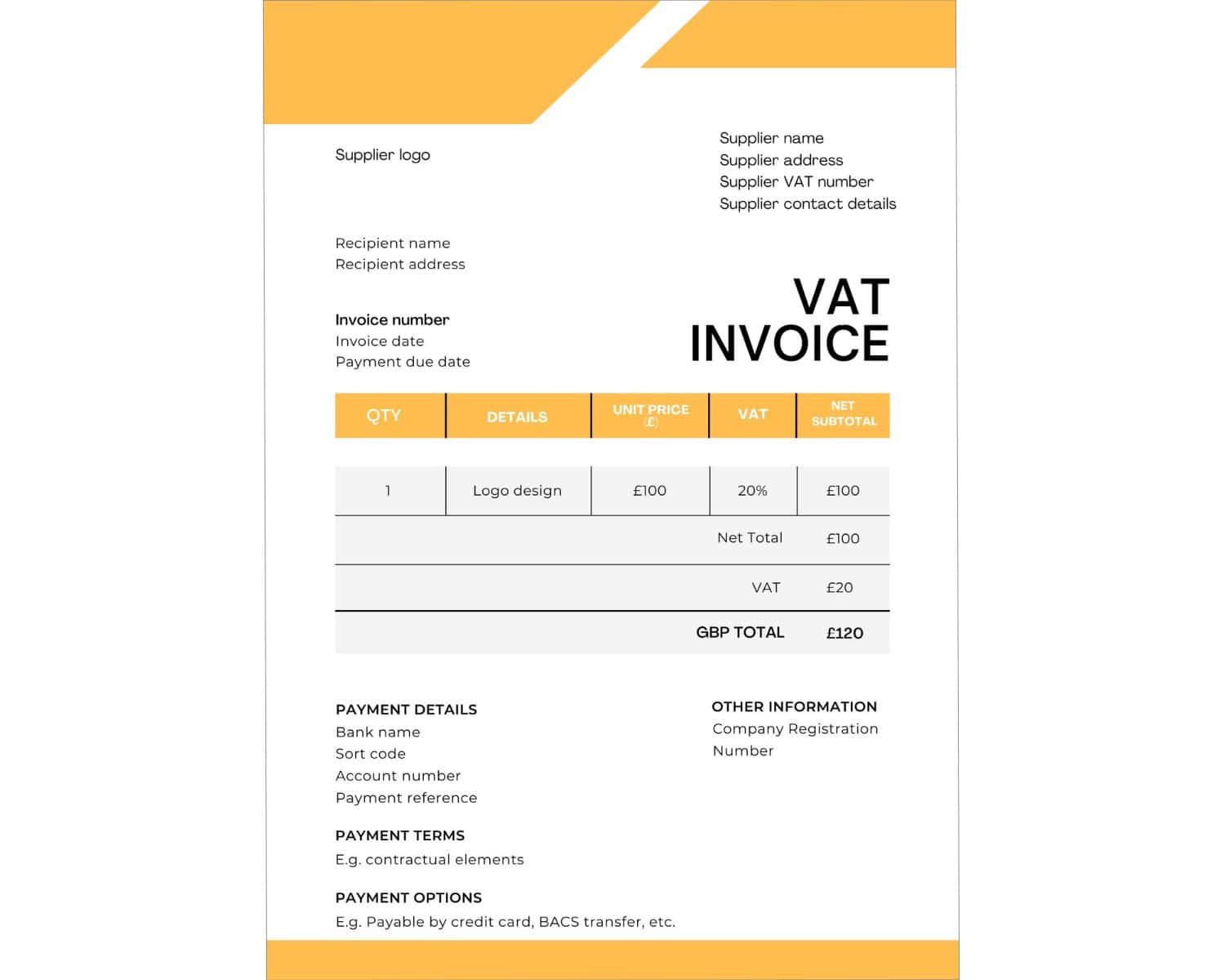

The company stationery requirements relating to invoices are slightly more extensive. The invoice of a limited company must show:

- A unique identification number

- Full company name as it appears on the certificate of incorporation (and trading name if it is different to the legal name)

- Registered office address

- Company registration number

- Contact information (business phone number and email address)

- A clear description of what the invoice is for

- Name and address of the company/person you’re invoicing

- The date the goods or service were provided

- Date of invoice issue

- Charge amount

- VAT amount (if applicable)

- Total amount owed

- Payment terms and options

If you’re VAT-registered, you’ll need to produce a VAT invoice. As well as the above, you must include your VAT registration number and either the VAT rate (standard, reduced, or zero-rated) and total VAT amount charged or the VAT amount and VAT rate per item. Here’s an example of a VAT invoice:

Author's Tip

Do you need to register for VAT? With the 1st Formations VAT Registration Service, our experts will prepare and submit your registration to HMRC for just £39.99 and provide comprehensive guidance throughout the process.

Requirements relating to the registered office

There are additional regulations relating to your place(s) of business. As well as on all business stationery, you must display a sign showing your company name at the registered office address or Single Alternative Inspection Location (SAIL) and anywhere your company operates.

For example, if you run three retail stores and have a commercial office (which is also your registered office), you must show a sign with your company name at all four locations. Signs must be easily read and visible at all times, including outside your business hours.

The only exception to this rule is if you run your business from home.

Additional business stationery disclosure rules

Depending on your company type, additional business stationery disclosure rules may apply. Regulation 25 of The Names and Trading Disclosures Regulations 2015 explains that you must also show:

(d) in the case of a limited company exempt from obligation to use the word “limited” as part of its registered name under section 60 of the Act, the fact that it is a limited company;

(e) in the case of a community interest company which is not a public company, the fact that it is a limited company; and

(f) in the case of an investment company within the meaning of section 833 of the Act, the fact that it is such a company.

(3) If, in the case of a company having a share capital, there is a disclosure as to the amount of share capital on—

(a) its business letters;

(b) its order forms; or

(c) its websites,

that disclosure must be as to paid up share capital.

Essentially, all companies must display their company type, which can sometimes go amiss due to exemption regulations. If you have share capital, the amount must also be disclosed on your business stationery.

Note that your company may also be subject to additional disclosure rules. For instance, financial firms also adhere to the regulations of the Financial Conduct Authority (FCA), so it’s essential to check if any further requirements apply to your industry.

Penalties

Directors are legally responsible for ensuring that the company adheres to company stationery requirements at all times. Failure to comply could result in the company and all its officers facing a fine of up to £1,000, plus £100 for every day the regulations are breached.

Conclusion

Whether based in the UK or abroad, running a UK-registered limited company comes with various laws and regulations, such as business stationery disclosure.

Primarily, you must clearly display your registered office address, registration number, and jurisdiction of registration on all business letters, order forms, and websites. However, depending on your company type and VAT registration status, you may have to abide by additional laws.

Thanks for reading. If you have any questions about company stationery, please post them below, and a member of our team will get back to you.

Please note that the information provided in this article is for general informational purposes only and does not constitute legal, tax, or professional advice. While our aim is that the content is accurate and up to date, it should not be relied upon as a substitute for tailored advice from qualified professionals. We strongly recommend that you seek independent legal and tax advice specific to your circumstances before acting on any information contained in this article. We accept no responsibility or liability for any loss or damage that may result from your reliance on the information provided in this article. Use of the information contained in this article is entirely at your own risk.

Join The Discussion

Comments (2)

Thanks for the article! These UK business stationery disclosure requirements will be helpful to know for my own business tax services UK.

You are more than welcome!

We are very glad you can apply this information to your own business.

Kind regards,

The 1st Formations Team